Many thanks to SWLing Post contributor, London Shortwave, who shares this fascinating article which takes a look at high-frequency trading firms:

(Source: Sniper in Mahwah & Friends)

Shortwave Trading | Part I | the West Chicago Tower Mystery

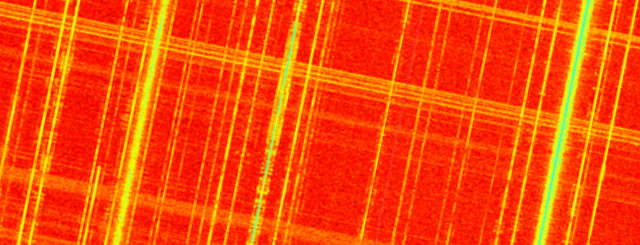

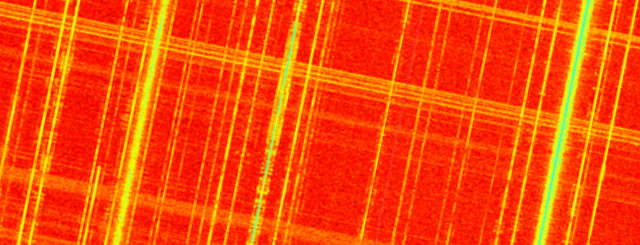

Since 2014 this blog has extensively covered the wireless networks built by high-frequency trading (HFT) firms or network providers to reduce latencies between the different exchanges around the world (market makers need fast connectivity to manage risk, news traders also need to be fast, etc.). This epic investigation on microwave, which started with HFT in my backyard, will be fully reported in a book I’m currently writing (in French for now). As I’m quite busy with this writing (and other/more interesting matters about market structure), I didn’t really have the time to check out what I have been hearing about “shortwave” or “high frequency” radio. This is the way high-frequency trading firms may use shortwave radio to directly connect widely-separated locations (in short, traders are willing to use shortwave to cross oceans with less latency than any fiber – like Hibernia).

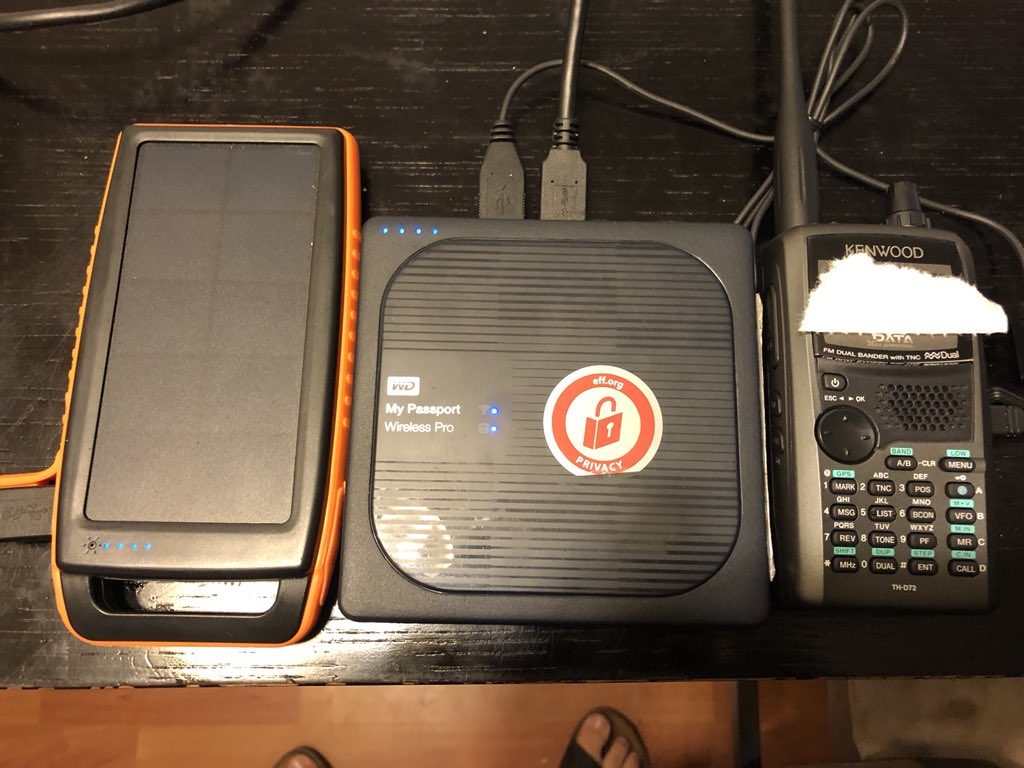

But recently I got more intel about the situation (and some fun anecdotes). With some help from the US, I found that a firm purchased a field for more than 1$M to build towers and antennas; with some help from the EU, I got hints about Germany; and I dug into UK public records. I even met, last March in Amsterdam, people involved in those projects. Not surprisingly, at least five HFT/market making firms showed up behind the shell companies/names they use to hide. The usual suspects. Above all, I have been contacted recently by someone from Chicago, Bob, who decided to investigate the “shortwave” networks in his backyard. Today I’m pleased to host Bob as a new guest writer on this blog. This first part of the “Shortwave Trading” series is released at the same time Bob is talking about what he found at the STAC Summit in Chicago. Next parts will follow soon.[…]

Read the full guest post by Bob (KE9YQ) at the blog Sniper in Mahwah & Friends.

This is a fascinating read, and it’s fun to follow Bob–who obviously knows his way around communications sites and the FCC–put all of the pieces together. I’m looking forward to his future posts.

I think it’s fascinating that while some are calling the HF/shortwave spectrum a dead, outdated medium, others are working in the background leveraging shortwave’s strong and unique properties as a communications medium:

- Shortwave requires no infrastructure between communication points

- Shortwave can be used to communicate over vast distances

- Shortwave needs no permission to cross borders

- Shortwave has no latency–signals/communications travel at the speed of light

- Shortwave communications are relatively durable, adaptive and are difficult/costly to intentionally block

As I’ve mentioned a number of times in the past–especially in this article from almost four years ago–while we may be seeing big government broadcasts sun-setting we haven’t seen the end of shortwave communications.